By Care com HomePay

When working with families and nannies on compensation, non-taxable benefits can save both parties money – and help bridge compensation gaps. Specifically, the IRS has a set of what they call “fringe benefits” that are considered non-taxable forms of compensation. This means the value of those benefits are not subject to taxes for the employer or the employee. Moving part of the compensation package over the non-taxable side of the ledger can help close more placements and pay big dividends for everyone involved.

2023 IRS-approved non-taxable compensation benefits for household employers:

- Health Insurance premiums from a state-licensed insurance provider.

Note: If you have multiple employees, you must set up an Individual Coverage Health Reimbursement Arrangement (ICHRA), Qualified Small Employer Health Reimbursement Arrangement (QSEHRA) or purchase a policy through SHOP (Small Business Health Options Program) to gain this benefit.

- Up to $300 per month toward public transportation to and from the worksite.

- Up to $300 per month toward parking at the jobsite and/or at the public transportation facility.

- Cell phone service reimbursement.

- Up to $5,250 per year towards tuition & books for an accredited college/university or payments toward a student loan.

“By asking some basic questions during the placement process, we can maximize these strategic benefits and minimize the gross (taxable) wages,” says Tom Breedlove, Sr. Director of HomePay. “It’s a simple way for agencies to help both clients and candidates get the best financial deal possible.”

A payroll example using non-taxable benefits

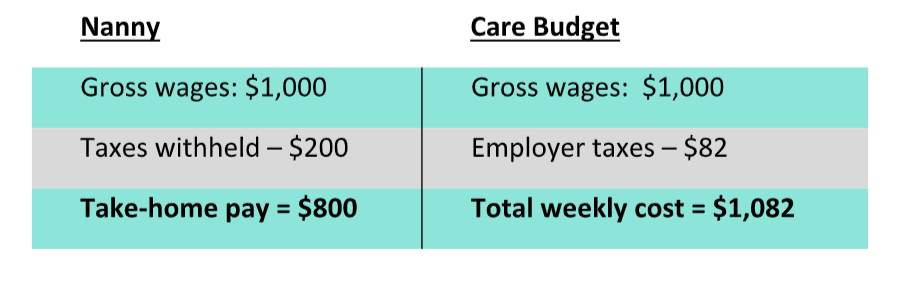

Let’s say a nanny is paid $1,000 per week with no additional benefits added and they fill out their Form W-4 as Single with no dependents. Each pay period, this is what the net (“take-home”) pay and care budget will be approximately:

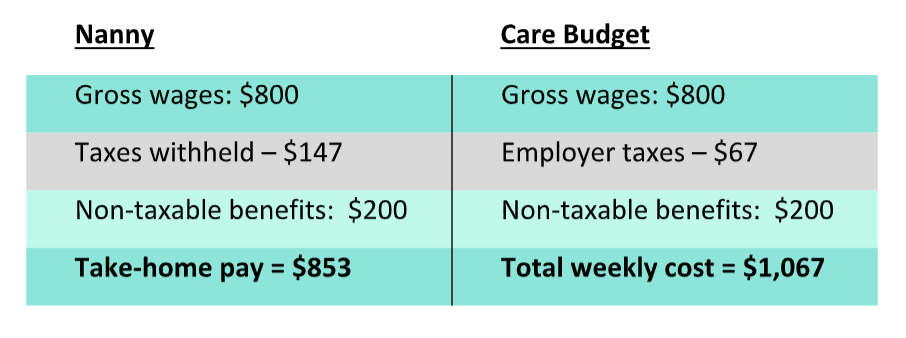

Now, let’s say the compensation package includes $200 in fringe benefits ($100 per week in health insurance, $40 per week for mass transit, $40 for parking, and $20 for cell phone). Even though the family is still paying $1,000 per week, the $200 of fringe benefits are excluded from taxes. The weekly take-home pay goes up while the care budget goes down:

As you can see, in this scenario, the nanny is saving $53 per week with these benefits added to their payroll. Over the course of the year, that adds up to over $2,750!

Meanwhile, the family saves $15 per week – or $780 for the year. The experts at HomePay are happy to help with structuring these types of strategic tax-advantaged compensation arrangements. Just call 877-367-1969, or email partners@myhomepay.com, and let’s make sure every client and every nanny is saving as much money as possible!